Scan with

your phone

MAY 31, 2020.

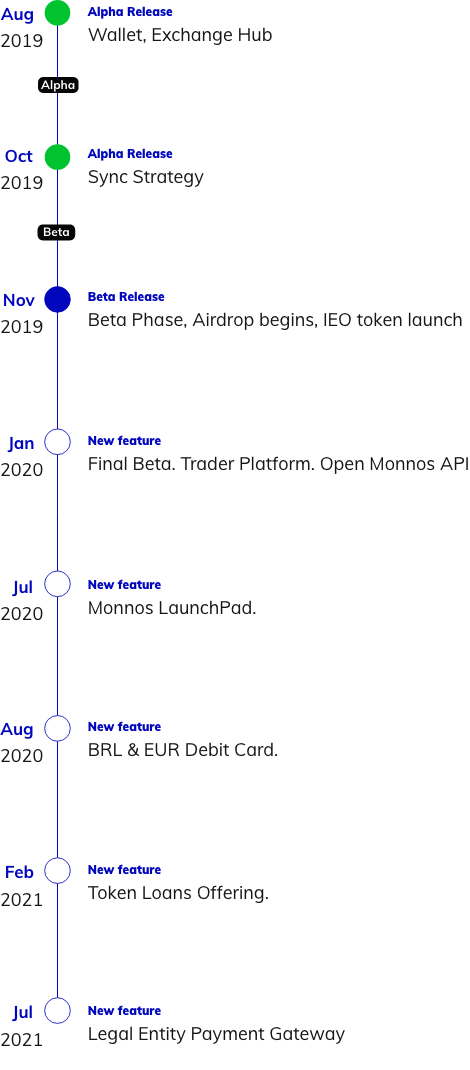

We are the first crypto company to offer an easy to use social trading platform in the crypto market. With our core functionality called Sync Strategies, users can synchronize their wallets. In this way, both beginners and experient users can win together. When you sync your wallet to someone it’ll copy automatically everything the user you are synched does.

START MAY 20th END MAY 31th

ERC-20

3,500,000,000 MNS

IEO INITIAL EXCHANGE OFFERING

To be defined

To be defined

We are solving two problems for two big markets at the same time. It is a billion-dollar market.

Most people are not day traders, they don’t have time or experience to micro manage their assets and they end up losing a lot of opportunities.

Giving them the posibility to copy automatically someone else strategies, we are giving them the ability to invest using the time and experience of another user.

We are giving experient users one more way to scale up their profits: they can let their wallets public and charge whatever they want to someone sync to them based on a subscription fee.

We are an all in one crypto account where everyone can make, share and follow crypto strategies.

Monnos is an initiative of Brazilian entrepreneurs that are born to be global and already serves 60 different countries. Closely monitor the disruption that Monnos will bring to the cryptoeconomics industry.

Product Available

4.9

Google Play Rating See here

5.0

AppleStore Rating See here

English, Brazilian Portuguese, Spanish (LATAM)

Available Languages Contribute

Sync Strategy

Sync Strategy  Crypto Deposit

Crypto Deposit  Cash Deposit

Cash Deposit  Crypto Withdraw

Crypto Withdraw  Cash Withdraw

Cash Withdraw  Crypto Market

Crypto Market  Digital Asset Wallets

Digital Asset Wallets  Strategy Wallets

Strategy Wallets  Account Activities

Account Activities  Portfolio Overview

Portfolio Overview  Account Password

Account Password  Access Code

Access Code  Fingerprint / Touch ID

Fingerprint / Touch ID  SMS Verification

SMS Verification  Email Verification

Email Verification  Google Authenticator

Google Authenticator  Quick KYC

Quick KYC  Monnos Shield

Monnos Shield  Session Control

Session Control We create our MONNOS (MNS) token and launch on multiple global platforms. The total amount to be issued is 3.5 Billion MNS Tokens using the Ethereum ERC 20 smart contract technical standard.

Monnos (MNS)

Token Name

Technical standard Source code

Future Market Pairs

May 2020

MNS Token Listing

3,500,000,000 MNS

Total Supply (100%)

To be defined

Token price during IEO

To be defined

To be defined

No lockup

Public Sale Vesting Period

MONNOS APP / PROBIT / LATOKEN

Sale Channels

![]()

![]()

![]()

![]()

Buy with (Monnos App)

![]()

![]()

![]()

Buy with (ProBit and Latoken)

KYC on Monnos App or Probit or Latoken Platform

Purchase Requirement

Country Restriction

CEO • Co-Founder

BUSINESS

CSO • Co-Founder

INTELIGENCE

CTO • Co-Founder

ENGINEERING

CDO • Co-Founder

PRODUCT

Head of Growth

MARKETING

Software Developer

ENGINEERING

Head of Android

MOBILE

Head of iOS

MOBILE

Front-end Engineer

WEB

Customer Success

Support

Customer Success

Support

FARIAS LIRA LAW FIRM

September 2019

The following is an opinion on the legal classification of the Monnos Tokens (MNS) according to the legal framework of the Swiss Confederation, the Federative Republic of Brazil and the European Union.

The consultation took place at the Brazilian law firm Farias Lira Lawyers, in favor of Monnos.

The question to answer is: “What is the legal classification of the Monnos Token according to the law of the Swiss Confederation, the Federative Republic of Brazil and the European Union (EU)?”.

To answer this question, we analyze the Monnos Token, its features, and its characteristics. Next, we explain the concept of tokens, their legal ramifications, and regulatory implications. Finally, we draw the profile of the Monnos Token, identifying its legal framework. The choice of the mentioned jurisdictions is justified by the company’s operational base being in Switzerland and the higher density of Brazilian and European Union national customers.

The Opinion’s conclusions consider (i) review of the September 2019 White Paper, Version 1.7; (ii) the analysis of related documents, notably the Monnos Platform Terms of Use; and (iii) analysis of the laws and positions of public authorities relevant to the topic.

For all intents and purposes, mentioning the Monnos Token (MNS) in this opinion, as well as any morphological variations and combinations of these expressions, will refer to the version of the token described in the White Paper 1.7, dated from September 2019. Consequently, it should be noted that this opinion concerns – exclusively – the token according to the legal and technological model described in White Paper 1.7. Any subsequent alteration, modification, development, reduction, etc. of its content is outside the scope of this Opinion and is therefore not necessarily consistent with the reasoning and conclusion set forth herein.

Also, for the purposes of this opinion, a crypto-asset will be conceptualized as any digital asset or digital token developed using cryptographic techniques and Distributed Ledger Technology (DLT).

The Monnos project consists of offering a mobile platform that proposes through technology and usability to facilitate the investment in cryptocurrencies and to empower this community in the search for seizing opportunities available in this segment. The features are exchange, wallet and sync strategy, among others.

Regarding the token, specifically, it is possible to observe some incentives to use the platform. In this sense, we have: (i) bonus for use; (ii) payment discounts; (iii) referral bonus and (iv) contribution bonus.

Considering the object of this opinion, only the characteristics of Monnos Tokens will be observed in its mother platform, where it acquires relevance, but separately from it. That is: only the nature of the token will be studied, and any functionality offered by the Monnos platform or other service is beyond the scope of this opinion. Thus, it will be assessed whether their characteristics are constitutive of securities for Switzerland, Brazil, and the European Union – focal jurisdictions of the company’s operation, as already discussed.

MONNOS PLATFORM TERMS OF USE

The Monnos Platform Terms of Use briefly address the Monnos Tokens in clause 8, explaining to the user the token generation mechanisms and the rights the token assigns to its holders.

The caput of this clause provides for the issuance of tokens within the platform itself, in specific situations. There is also provision for incentive programs and mention of token issuance.

The first enticement program is called the “Bonus for Use”. Any amount spent on the Monnos platform – if not spent on MNS tokens – will be converted to Monnos Tokens, in a proportion not shown in this document. The following program grants discounts – to be defined – to those who make payments for services offered on the platform, provided that the transaction is made with Monnos Tokens. This recognizes the MNS token as a means of payment.

Finally, it is foreseen the possibility of actions and promotions, to be created to stimulate the accumulation of tokens and the use of functionalities, according to Monnos interest.

WHITE PAPER MONNOS TOKEN VERSION 1.7 AUGUST, 2019

As already explained, the analysis of this opinion will be based on the qualities of the Monnos Token which, in the White Paper, are described in sections 10 – MNS Token, and 11 – Ecosystem.

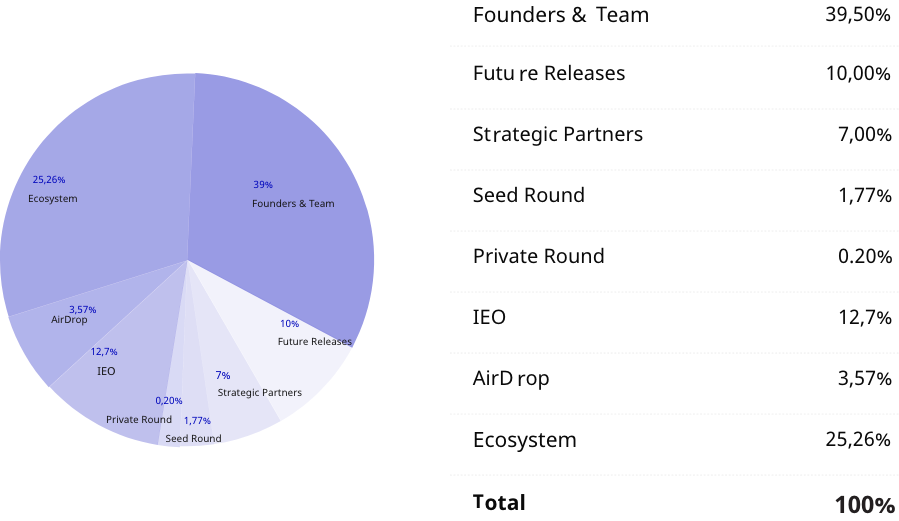

In short, 3.5 billion Monnos Tokens are expected to be issued under the smart contract technical standard ERC 20 (Ethereum). This amount will be split between founders & team (39.5%), future releases (10%), strategic partners (7%), seed round (1.77%), private round (1.11%), IEO (11, 84%), airdrop (3.57%) and ecosystem (25.55%). There is also the prediction, under the name of the annual team bonus, that from 2020 Monnos’ executive team will receive their bonuses in MNS tokens.

Pieces of greater relevance to this opinion are found in section 11 of the White Paper. Two pages of enticement programs for platform users are described, programs which are subject for further analysis.

The first program is called a “bonus for use”, described as a reward for platform use. Amounts paid by trading users will return to them at a third of their MNS tokens value. There is no restriction on the payment method here – it is only mentioned that the duration of this bonus will be six months after the funding.

Subsequently, as a reward for using MNS tokens, the payment discount grants those who choose to pay for Monnos Tokens trading’s a 50% discount in the first year of use, 25% in the second year, and 15% in the third year.

The referral bonus, the third expected benefit, encourages referral of the platform to potential customers. If the nominee chooses Monnos for trading, the referring user will receive, for 12 months, after the new user joins, 20% of the revenue obtained.

As an advantage intended for those who contribute to the development of the platform, the contribution bonus pays Monnos Tokens to perform specific activities at pre-established values.

Although it does not provide further details, there is a mention of enticements and promotions. There is an enticement to use features and token accumulation. Finally, it is foreseen the elimination (burning) of Monnos Tokens under specific conditions, to reduce the available supply, thus enhancing the rest.

The conceptualization and classification of CRYPTO-ASSETS as a security or as another category (utility or payment) derive from the need to delimit the State’s power of interference in this field1. It is essential to understand that economics creates its realities, such as the

1 MATTOS FILHO, Ary Oswaldo. The Concept of Securities. Rev. adm. business., São Paulo, v. 25, n. 2, p. 37-51, June 1985

monetary phenomenon; however, it is up to the Law to appropriate these facts to construct the deontological substratum of social action – opting for the creation of regulated and unregulated spaces for economic agents to act, per under principles that guide them.

Such considerations are essential to understand the reasoning that guides the conceptualization of a particular element (a crypto-asset, for example) as security. Although it is a language created by the Law, structured according to technical and political options, the legal fact is known as ‘security’ is grounded in the domain of economic reality, which is by nature dynamic and changeable, always ahead of the labels of the law.

Moreover, it is noteworthy that the term “security” has a flexible meaning in Comparative Law, not yet having universally accepted doctrinal and legislative correspondence2. There are several reasons for this, although there is no room for exhaustive comments in this paper. Legal inheritance and the historical experience of states concerning facts of significant socioeconomic impact are the prime factors for the legislative choices that have resulted in the current regulatory framework of state financial systems.

To get a sense of the conceptual exuberance around the subject, it is necessary only to look at the American concept of security (sec. 2 (a) (1) of the Securities Act), the Germanic concept of wertpapier (§ 2, abs. 1 of Wertpapierhandelsgesetz), the Italian concept of valore mobiliare (art. 1-bis of the Testo Unico della Finanza), the Spanish concept of tradable value (art. 2 of the Ley de Mercado de Valores), or the Portuguese concept of securities (art. 1 of the Portuguese Securities Market Code).

Thus, in the absence of a general and abstract understanding of the subject, it can be concluded that what is considered securities in the US may not be in Switzerland or Brazil and vice versa. In these terms, it is observed that there is no uniform categorization to classify crypto-assets. One of the most common classifications, however, is that which divides tokens into payment tokens, asset tokens, and utility tokens. This is how you understand the financial authority of Switzerland, the FINMA – Financial Market Supervisory Authority in its Guideline published in February 20183.

2 ANTUNES, José A. Engrácia. Securities: Concept, Species and Legal Regime. Available at: https://repositorio-aberto.up.pt/bitstream/10216/82791/2/49782.pdf. Accessed Aug 19 of 2019.

3 FINMA ICO Guidelines. 2018. Available at:

4 Art. 98 Banques et assurances. 1 La Confédération légifère sur les banques et sur les bourses en tenant compte du rôle et du statut particuliers des banques cantonales. 2 Elle peut légiférer sur les services financiers dans d’autres domaines. 3 Elle légifère sur les assurances privées.

SWISS CONFEDERATION NORMATIVE ABOUT TOKENS

The art. 98 of the Swiss Constitution gives the Federal Union competence to legislate on the banking, stock market and financial system in general. Check it out4:

Art. 98 Banks and insurance companies. 1 The Confederation legislates on banks and stock exchanges, considering the role and special status of cantonal banks. 2. It [the Confederation] may legislate on financial services in other areas. 3. It [the Confederation] legislates on private insurers. (free translation)

As a result, the Swiss State has structured the federal financial and capital market regulatory system and established an administrative authority to handle the matter, the Swiss Financial Market Supervisory Authority (FINMA).

The Financial Market Supervision Act (FINMASA) is the federal law that states that FINMA will be the authority that will supervise banks, insurers, and other financial intermediaries on behalf of the state. FINMASA thus constitutes the general law for other federal acts with provisions related to financial market supervision.

According to the law, FINMA is an autonomous regulatory authority responsible for ensuring the functioning of the financial market, focusing on four main tasks: licensing, supervision, enforcement, and regulation.

As a result, FINMA has issued two guidelines on the regulatory treatment of ICOs, which contribute to better understanding the application of capital market legislation to CRYPTO-ASSETS and ICOs. The first of these was published on September 29, 2017, entitled “FINMA Guidance 04/2017: Regulatory treatment of initial coin offerings”5. In this document, FINMA has indicated that it does not have specific legislation for ICOs. However, he stated that equity, debt capital raising, deposit-taking, and financial intermediation activities are controlled by existing laws that protect creditors, depositors, and investors, ensuring the proper functioning of the financial market.

ICOs, still in the wake of Guidance 04/2017, may have several links to the laws that regulate the financial market, depending on the structure of the services provided, particularly concerning provisions (I) against money laundering and financing terrorism; (ii) banking legislation; (iii) securities trading; and (iv) set forth in the bill of collective investment schemes. In any case, he stated that the analysis made is case-by-case, that is, carried out on a case-by-case basis, given the wide variety of ICOs and the different structural models they have.

5 Available on:

6 Available on:

Subsequently, on February 16, 2018, FINMA issued a new document on the regulatory framework for ICOs, calling it Guidelines for Inquiries Regarding the Regulatory Framework for Initial Coin Offerings (ICOs)6. In this regulatory guideline, FINMA indicates general principles

to categorize tokens based on their functionalities and then identify the corresponding legislation. In this path, FINMA proposes three general categories of crypto-assets: payment tokens, asset tokens, and utility tokens. As a general principle, FINMA establishes in its analysis that its most relevant tool is the study of the economic purposes of an ICO.

This way, payment tokens are CRYPTO-ASSETS used as a payment method which is intended for use now or in the future as a payment method for the purchase of goods or services or as a means of transferring money or value without providing any exogenous right to your username. By following its Guidelines, FINMA does not consider these cryptocurrencies as securities.

Utility tokens, in turn, provide access to a platform based on Blockchain technology. If such access tokens, also called platform tokens, are not for investment purposes and may be used to provide digital access to an application or services, FINMA will not treat them as investments.

However, FINMA has some requirements that deserve attention. First, if the token utility has any investment function, the ICO would constitute a sale of a security.

Furthermore, if during the ICO of a token utility no platform or application is providing the purchaser with utility, the acquisition will be considered a pre-sale – which, in FINMA’s interpretation, constitutes the sale of a security. Also, any pre-sale that gives investors the right to claim token purchase in the future will be treated as securities, regardless of the type of token it may be (albeit utility itself).

Therefore, for ICO tokens to be considered utility in Switzerland, they must avoid the three exceptions mentioned. That is, to be considered utility, at the time of ICO, the offered tokens must already grant access to the digital platform, enabling the use of their rights or use of services, have no investment function and do not indicate a pre-sale. Besides, to be considered as a utility, tokens cannot be offered in a way that gives their holder a future right (whether to the company or other purposes).

Asset tokens, in turn, represent assets, being qualified as investments by FINMA. These are those tokens that promise a stake in the company’s future earnings or capital flows. In terms of their economic function, therefore, these tokens are analogous to stocks, bonds, or derivatives.

Tokens that allow exogenous assets to be traded on the blockchain also fall into this category. Also, as noted, tokens that do not meet the above requirements for utility token classification are asset tokens.

The above token classifications are not mutually exclusive. Asset-type and utility-type tokens can also be combined and are also classified as payment tokens (cryptocurrencies). In this case, such tokens are considered hybrid tokens, and the requirements imposed by the authorities are cumulative.

The documents cited were a breakthrough in the qualification of tokens internationally. However, it should be borne in mind that, despite shedding light on some regulatory aspects through these guides, FINMA continues to examine on a case-by-case basis the application of the current financial legislation in Switzerland, enjoying the highest degree of discretion.

SUBSUMPTION

Given the above considerations regarding the classification of tokens in Switzerland, we have the following parameters:

1. Payment Tokens are payment tokens (synonymous with cryptocurrencies) used as a means of payment for the purchase of goods or services, or as a means of transferring money or value. Cryptocurrencies do not give rise to claims about the issuer.

2. Utility Tokens, in turn, are tokens intended to provide digital access to an application or service through a blockchain-based infrastructure.

3. Security or Asset Tokens represent assets, such as a debt or equity claim on the issuer. Asset tokens promise, for example, a share in the company’s future earnings or future capital flows. In terms of their economic function, therefore, these tokens are analogous to stocks, bonds, or derivatives. Tokens that allow physical assets to trade on blockchain also fall into this category.

4. The categories indicated are not mutually exclusive; there are, for example, utility and asset tokens considered simultaneously payment, which is commonly referred to as hybrid tokens.

Following this brief recap, it is appropriate to make the Monnos Token subsumption judgment based on these parameters.

Recalling the ecosystem proposed in the White Paper under review, the MNS token can be used as payment for services within the platform – even generating discounts for those who do so. By enhancing the use of the token as a payment method, contributions to the Monnos platform will be rewarded with receiving MNS tokens.

The utility token aspect, on the other hand, is among the advantages promised through incentives and promotions: The White Paper, on page 20, mentions that users who achieve specific goals “may have access exclusivity and other particulars focused on this context”.

The Monnos Token thus accumulates the function of payment token and utility token, and can, therefore, be characterized as a hybrid token.

On the other hand, holding any amount of Monnos Token does not entitle its holder to a stake in the company or a distribution of its profits, which is why the token does not qualify as a security/asset token. Similarly, the Monnos Token is neither an underlying asset representation instrument, again dismissing security/asset classification.

Returning to the 2018 Guidelines made by FINMA, it is extracted from its pages.

4 and 5:

Payment tokens / cryptocurrencies

[…] Given that payment tokens are designed to act as a means of payment and are not analogous in their function to traditional securities, FINMA will not treat payment tokens as securities. […]

Utility tokens

Utility tokens will not be treated as securities if their sole purpose is to confer digital access rights to an application or service and if the utility token can be used in this way at the point of issue. In these cases, the underlying function is to grant the access rights and the connection with capital markets, which is a typical feature of securities, is missing.

If a utility token additionally or only has an investment purpose at the point of issue, FINMA will treat such tokens as securities (i.e., in the same way as asset tokens).7

As can be seen, since there is no possibility of using the token as an investment, it is not characterized as a security/asset token and is not under FINMA regulation. Since this is the case for Monnos Token – there is no investment attribute – it does not depend on the authorization granted by FINMA to circulate.

3.2.1 Payment Tokens / Cryptocurrencies. […] Since payment tokens are designed to function as payment methods and are not analogous in their function to traditional investments, FINMA will not treat payment tokens as investments.

3.2.2 Utility Tokens. Utility tokens will not be treated as investments if their sole purpose is to provide digital access to an application or service and if the utility token may be used in this manner when issued. In these cases, the underlying function is to allow access rights and the connection with the capital market, typical of investments, is absent. If a utility token additionally or only has an investment purpose at the time of issue, FINMA will treat such tokens as investments (i.e., as tokens assets). Free translation.

The Brazilian National Financial System is structured by the Law as mentioned above No. 4.595/64, which lists its members: The National Monetary Council, the Central Bank of Brazil, and other financial institutions. The fourth article of this diploma contains the more than thirty attributions of the National Monetary Council, without mentioning the power to discipline the crypto market.

The regulatory power of the Central Bank of Brazil, in turn, finds support in arts. 9th to 11th of the same law. The first of the three articles, more briefly, gives the Central Bank the duty to “comply with and enforce the provisions assigned to it by the legislation in force and the rules issued by the National Monetary Council”. The following article gives the Central Bank powers such as “exercising credit control in all its forms” (item VI), “effecting control of foreign capital under the law” (item VII), “exercising the supervision of apply the penalties provided ”(item IX),“ grant authorization to financial institutions, so that they can: operate in the Country; install or transfer their headquarters or facilities, including abroad ”(item X, points a and b), among others. It is also worth noting that such functions are exclusive of the Central Bank.

The art. 11 of Law No. 4,595 / 64, the last to list the attributions of the Central Bank, establishes, among other functions, “to exercise permanent vigilance in the financial and capital markets over companies that directly or indirectly interfere in those markets and in relation to operational modalities or processes which they use ”(item VII).

It is also interesting to highlight the concept of a financial institution. Under the terms of art. 17 of Law No. 4.595/64:

Art. 17. For the legislation in force, financial institutions are considered to be public or private legal entities that have as their primary or accessory activity the collection, intermediation or application of their own or third-party financial resources, in national or local currency and the custody of the property value of third parties.

Single paragraph. For this law and the legislation in force, financial institutions are equivalent to individuals who carry out any of the activities referred to in this article, permanently or occasionally.

At this time, a distinction is made between virtual currency and electronic money. According to Announcement 31.379/20178, the Central Bank of Brazil does not regulate, authorize, or supervise companies that trade or store virtual currencies – understood as crypto- assets. On the other hand, the concept of electronic money, according to the same Announcement, is “a mode of expression of credits denominated in reais”, as defined in art. 6 of Law No. 12,865 / 2013. In fact, “so-called virtual currencies are not referenced in reais or other established currencies

8 BRAZILIAN CENTRAL BANK. Release No. 31,379 of November 16, 2017. Available at:

by sovereign governments,” according to the Announcement. Thus, any mention in the electronic money legislation should not be confused with the definition of crypto-asset.

It could be argued that crypto-assets securities, although not fiduciary coins, fit into the broad concept of currency, thus attracting the authority of the Central Bank for its regulation. However, returning to the Announcement as mentioned above, it reports that “there is no specific provision on virtual currencies in the legal and regulatory framework related to the National Financial System. The Central Bank of Brazil does not regulate or supervise virtual currency operations.” Thus, the distinction persists between virtual and non-virtual currency and crypto-electronic money, the latter not disciplined by the Central Bank.

At this point, we briefly comment on the consideration of crypto-assets factors in the trade balance analysis. At the recommendation of the International Monetary Fund9, the Central Bank10 now classifies crypto-assets as non-financial assets produced by including them in the balance of payments asset account – “[a] cryptocurrency mining activity is therefore treated as a productive process”. However, this addition to the trade balance calculations does not imply currently creating regulation for the sector.

Returning to the analysis of the National Financial System, we proceed to Law No. 6.385/76, which provides for the securities market and creates the Securities Commission (CVM). CVM’s attributions are among the arts. 8 and 11, which include “regulating, in compliance with the policy defined by the National Monetary Council, the matters expressly provided for in this Law and the Brazilian Corporate Law” (art. 8, I) and “permanently supervising the activities and securities market services, as referred to in Article 1, as well as the disclosure of information relating to the market, the persons participating in it, and the securities traded therein” (art. 8, III). From the mentioned article 1, it is emphasized that “the following activities will be disciplined and supervised according to this Law: the issuance and distribution of securities in the market […]”.

This brief analysis of the National Financial System aims to identify possible regulatory bodies for the crypto market. Initially, there is no regulatory body for this market segment. Likewise, there is direct mention of crypto-assets within the rules of the National Monetary Council, which has so far abstained from issuing regulations on the matter.

The Central Bank of Brazil, as mentioned above, has removed itself from its regulatory competence for crypto-assets; Likewise, the concepts of currency and crypto are not confused, so that the scope of this body’s capability is not to be seen.

9 INTERNATIONAL MONETARY FUND. Treatment of Crypto Assets in Macroeconomic Statistics. Available in

10 Available at

However, the possibility of regulating crypto securities by the Securities Commission remains. For this to happen, however, the crypto must be subject to classification as a security asset. In this sense, two notes issued by the institution position it in this way. The first, dated October 11, 201711, provides as follows:

2. In this context, the CVM clarifies that certain ICO transactions may be characterized as transactions with securities already subject to specific legislation and regulations and must comply with applicable rules. Companies (whether open or not) or other issuers that raise funds through an ICO are engaged in transactions whose economic meaning corresponds to the issuance and trading of securities.

3. Offers of virtual assets that fall within the definition of securities and that are not in compliance with the regulations shall be deemed to be irregular and, as such, shall be subject to applicable sanctions and penalties. […]

4. On the other hand, there are ICO operations that are not under the competence of the CVM, as they are not public offerings of securities.

CVM’s second statement, dated March 7, 201812, states that “that [the CVM] is responsible for regulating the offer and trading of assets that fit the legal concept of securities, and those that do not have that characteristic.”

On the other hand, a recent case involving the site https://atlasquantum.com/ resulted in sanction by the Commission, through CVM Resolution 82613. From this, it is extracted:

The. CVM has found that Atlas Services in Digital Assets LTDA, CNPJ No. 31.049.719 / 0001-40, Atlas Proj Technology EIRELI, CNPJ No. 26.768.698 / 0001-83, Atlas Services – Business Management Consulting and Administrative Support Services , CNPJ No. 30,608,097 / 0001-80, Atlas Project International Ltd. (company based in the British Virgin Islands), Atlas Project LLC (company based in Delaware – USA) and Mr. Rodrigo Marques dos Santos, CPF No. 282,301,848 -44, have been offering, on the World Wide Web page https://atlasquantum.com/, an investment opportunity whose remuneration would be linked to the automated buying and selling of crypto products through arbitration algorithms, using public appeal to enter into contracts that, as offered, fit into the legal concept of securities;

Due to current legislation, securities or collective investment agreements that generate the right to participate, partnership or remuneration, including those resulting from the rendering of services, the proceeds of which are the efforts of the entrepreneur or third parties may only be offered publicly by registration of offer or dismissal with the CVM; (our emphasis)

As can be seen, the Securities Commission considered that the case was under its jurisdiction because the investment remuneration is linked to “the result of the companies’ efforts to provide crypto trading services, in a strategy called arbitrage” 14. For this reason, it is necessary to study the positioning of the CVM concerning crypto-assets.

11 Available at:

12 Available at:

13 Available at:

14 SECURITIES COMMITTEE. Irregular offer of Collective Investment Agreements (CIC). Available at:

NORMATIVE OF THE FEDERATIVE REPUBLIC OF BRAZIL ON TOKENS

Brazil, as already seen, does not have specific legislation to discipline CRYPTO-ASSETS. There are bills underway for this purpose, but now, no current law. However, the Securities and Exchange Commission has not yet departed from its jurisdiction to regulate the supply of crypto securities in Brazil – on the contrary, in a recent determination CVM reinforced its position as a possible regulator of this market.

Under Brazilian law, the capital market and, more specifically, bonds considered securities, must comply with Law No. 6.385 of 1976, already mentioned. According to art. 2 of Law No. 6.385/76, are the following:

I – the shares, debentures, and warrants;

II – the coupons, rights, subscription receipts and split certificates related to the securities referred to in item II;

III – the certificates of deposit of securities; IV – the debenture notes;

V – the quotas of securities investment funds or investment clubs in any assets;

VI – the commercial notes;

VII – futures, options and other derivatives contracts, whose underlying assets are securities;

VIII – other derivative contracts, regardless of the underlying assets; and

IX – when offered publicly, any other securities or collective investment agreements that generate the right to participate, partnership or remuneration, including resulting from the rendering of services, whose income derives from the efforts of the entrepreneur or third parties.

The elucidation proposed – crypto falls under the concept of securities – is not quickly resolved, because there is not just one type of crypto. As already discussed, the Swiss authorities, for example, differentiate between payment tokens, utility tokens, security tokens, and hybrid tokens. The subsumption to the Brazilian norm will necessarily go through the analysis of the token’s characteristics.

Before entering this field, however, it is useful to conceptualize the different kinds of securities. Starting with the shares, these are portions of the capital stock of companies or joint-stock companies; These are equity securities that grant their holders (shareholders) the rights and duties of a partner within the limit of the shares held. Debentures, in turn, are debt securities issued by corporations that confer credit rights against the issuer; they are fundraising instruments used to finance projects and manage debt15.

Subscription Bonds are negotiable securities issued by joint-stock companies that entitle them to subscribe for shares of the capital stock within a specific limit authorized in the bylaws; may be assigned as an additional advantage to the subscribers of the shares or debentures and may also be disposed of. The Promissory Notes (as known as “Commercial Papers”) are

15 SECURITIES COMMITTEE. Brazilian Securities Market. 3rd ed. Rio de Janeiro: Securities Commission, 2014, p. 72 et seq.

securities that represent a promise to pay the issuer (the debtor) to the payee (the creditor) of a certain amount on a certain date; It is a negotiable document representing debt. In its turn, the finance letter is debt security exclusively issued by financial institutions, also consisting of a promise to pay nominal, transferable and freely traded money16.

Investment Funds are condominiums organized to raise and invest funds in the Financial Market; Its purpose is to promote the collective application of resources of its owners. The shares issued by Investment Funds are securities. Investment Clubs, consisting of a minimum of three and a maximum of fifty individuals, are intended to invest in securities; they resemble Investment Funds but are more restricted17.

Brazilian Depositary Receipts (BDRs) are nationally issued securities that represent other securities of a publicly traded company abroad. This title is regulated by CVM Instruction No. 332/2000, which divides the BDR into three levels and orders the depositary institutions (the institution that issues the BDR in Brazil). Real Estate Receivables Certificates, in turn, are regulated by Law No. 9.514/97, which regulates real estate financing; They are book-entry and transferable nominative credit notes backed by real estate loans and are issued exclusively by securitization companies (non-financial institutions)18.

The Building Additional Potential Certificates (CEPAC) are regulated by Law No. 10.257 / 2001 that regulates the Urban Policy. This law provides for the establishment of urban consortium operations that have specific rules aimed at attracting private investment, among them the “additional building rights”. The regulations authorize municipalities to grant these rights to interested parties upon payment of a consideration; CEPAC19 represents the rights.

As can be seen, the qualification of crypto assets as securities is incompatible with the above securities, due to their characteristics. Thus, in the absence of specific regulation, the potential characterization of blockchain tokens or any atypical instrument as security will occur through items VII, VIII – Derivatives – or IX – Collective Investment Agreement (CIC) – of art. 2 of Law No. 6.385/76.

Of the three items, more attention is usually paid to the last one. This is because its wording offers the most open structure to the list that was until then exhaustive, not limited to typical contracts and securities, but also includes any trading forms that represent securities, assets or values, called Collective Investment Agreements. This was the framework made by CVM in Resolution 826 above. On the other hand, derivatives assume the existence of an

underlying asset20, which is not always present in the structure of a crypto-asset.

Collective Investment Agreements are understood as investor fundraising tools for the application of these funds in an enterprise to be implemented and directed by the entrepreneur or third party with the future promise of redistributing profits among investors. CICs are subject to CVM regulation and supervision, which requires the registration of issuers and public distributions under the aegis of disclosure and transparency rules imposed by Brazilian Law21.

Accordingly, item IX of art. 2 of Law No. 6.385/76 extends the concept of security when it encompasses CICs and may adapt to the generic structures created by those who wish to raise money from third parties – a situation that resembles them to US securities. In this sense, the Securities Commission, through MEMO / CVM / SRE / nº 09/200922, recognizes the proximity between item IX of the national regulations and the Howey Test criteria23. Likewise, in 2008, CVM RJ2007/11593, and CVM RJ2007/13207, were the two leading votes of Director Marcos Pinto24.

Considering the brevity of the numerous existing precedents, a quick analysis is made only of the case Niobium – a utility token submitted to the Howey Test by CVM. Such application was made in the Memorandum No. 92/2017-CVM / SRE / GER-3, from which it is extracted:

6. Following is the analysis conducted by applying the Howey Test on the characteristics of the Niobium Coin ICO offering:

6.1. Is there an investment? Yes. Investors would invest resources in exchange for

receipt of Niobium Coin. As can be seen from the White Paper (0394115, new version 0405480), interested parties will acquire Niobium Coin from Bitcoins and Ethereums trading; however, these other currencies can be purchased with financial resources.

6.2. What if a bond or a contract formalizes this investment? Yes. According to Reply to Official Letter 192 (0399354), the investment is formalized as follows:

20 SECURITIES COMMITTEE. Brazilian Securities Market. 3rd ed. Rio de Janeiro: Securities Commission, 2014, p. 308

21 SECURITIES COMMITTEE. Brazilian Securities Market. 3rd ed. Rio de Janeiro: Securities Commission, 2014, p. 88

22 Available at:

23 The precedent of the United States jurisdiction, leading case creator of the “Howey Test” – a test that consists of analyzing possible framing as a movable asset through a questionnaire. Statement of SEC case v. W. J. Howey Company available at:

24 First vote available at:

“Niobium purchasers need to provide email and provide a Niobium compatible Ethereum account, i.e., a wallet address to proceed with the exchange. Formalization is by receiving a standard email (attached copy) (doc. SEI – 0399355) by the acquirer, indicating the procedure for exchanging Ethereums for Niobiums. ”

6.3. Is the investment collective? Yes, as it will be offered and purchased

indistinctly to the general public.

6.2. Is some form of compensation offered to investors? No. According to the disclosed documents, there is no form of payment, participation, or partnership provided to investors. The information contained in the White Paper and supplied by the subpoena also states that the rights of Niobium Coin holders are not those described in Art. 2nd of Law No. 6.385 / 76, as seen in the excerpts highlighted below:

“Also, because in this offer, there is no offer of participation, partnership, or compensation.” White Paper (p. 17)

“From now on, it is clear that Niobium is a utility token, as its purpose is to use it as a credit to pay for services rendered or to purchase other virtual currencies on the BOMESP platform and can be exchanged on several other existing platforms. around the world.

Niobium does not grant its acquirers any “right of participation, partnership or remuneration, including as a result of the rendering of services” characteristics present in item IX of art. 29 of Law No. 6,385 of 1976, for characterization as security.

Any equity gain arising from the appreciation of the good (as occurs, for example, with a property, a car or a jewel), will result from the recognition that the company will make about the intrinsic value of the currency, within the law of supply and demand, vis in view of the possibility (future or current) of use in BOMESP, and not of a right of participation, partnership or remuneration.” Reply to Official Letter 192 (0399354)

6.5. The compensation offered comes from the entrepreneur’s efforts or

third parties? No. No compensation will be provided.

6.6. Are contracts publicly offered? Yes, the investment proposal, which

according to the website, https://niobiumcoin.io/ is in the pre-sale phase; it is being provided to the general public through a website.

CVM’s Collegiate Decision25 not to characterize securities assets, as follows:

The Board accompanied the manifestation of the technical area, embodied in Memorandum No. 19/2017-CVM / SRE, supplemented by Memorandum 7 / 2018- CVM / SRE / GER-3, in the sense that the cryptocurrency or utility token Niobium Coin, in The strict terms in which it was submitted to the CVM to date is not characterized as a security, which is why the CVM would not have jurisdiction over its intended Initial Coin Offering (ICO).

As can be seen, the Howey Test is a fundamental tool for the characterization or not of a security under the terms of item IX of art. 2 of Law No. 6.385/76. For this reason, the subsumption will follow such guidelines.

25 Available at:

SUBSUMPTION

As explored, the Monnos Token is incompatible with the securities of items I to VIII of art. 2 of Law No. 6.385/76. Its possibility of being framed as such, therefore, rests on the open wording of item IX: “when offered publicly, any other securities or collective investment agreements that generate participation, partnership or remuneration rights, including those resulting from the rendering of services, whose income comes from the efforts of the entrepreneur or third parties ”.

Similarly, precedents have already been set by the Securities and Exchange Commission, reiterating the use of the Howey Test to assess the appropriateness of the object under consultation with the said item IX. The test consists of six questions, and the negative answer to only one of them is enough to make qualification as unfeasible.

Of the questions below, four of the six questions that make up the Howey Test are answered positively, while two of them are responded to negatively, thus misinterpreting the Monnos token as a security. Therefore, the last two are analyzed together.

Pass to the test application:

Is there an investment? Yes. Monnos customers use funds to receive that token in return.

Is this investment formalized by a bond or a contract? Yes, by accepting the Terms of Use made available on the company’s website.

Is the investment collective? Yes, once it is offered – and can be accepted – by any individual.

Are contracts publicly offered? Yes. The investment proposal is provided publicly through an online platform.

Is any form of remuneration offered to investors? Does the compensation offer come from the efforts of the entrepreneur or third parties?

The simple answer to these questions is no, Monnos Token offers no compensation whatsoever, no right to participate or partnership. Token holders should not expect to receive any amounts – in cash or crypto – as a direct consequence of keeping them in their possession. Thus, the qualification as a collective investment contract is removed. However, the White Paper mentions some bonuses offered by the company to token holders. Because care is taken, brief considerations are devoted to these bonuses: by use, by referral, and by contribution, in addition to granting discounts.

Starting with the granting of discounts, this is nothing more than the simple broad-mindedness of the company. Discounts are offered fixedly and transparently, regardless of how many tokens the user has.

Similarly, the bonus for use does not match the token holding – on the contrary, it is by spending tokens that such a reward is obtained. Even the Bonus Referral Program description in Terms of Use can be recognized as an incentive system to consume the platform’s products and services by awarding Monnos Tokens. Any intricacies of this system are related to the fluctuation in the number of tokens to be delivered by awards, which does not detract from the character of a system of incentive to consumption.

The contribution bonus is a reward system for those who contribute to the development of the Monnos platform. This figure is therefore close to a small remuneration for service rendered, not related to the previous holding of the token.

In turn, the referral bonus could suggest compensation due to a third-party effort, a condition that would alter responses to the Howey Test. However, two CVM precedents are mentioned: The Carbon Credit case (CVM Administrative Case No. RJ 2009/6346) and the recent case of Atlas Quantum (Memorandum 93/2019-CVM / SRE / GER-3).

In the case of Carbon Credits, the Director’s vote26, this winner’s vote, defined as follows:

I believe that if, in the case of CEPACs or CCBs, it was possible, under the specific conditions, to characterize those instruments like securities, the same cannot be done for carbon credits.

Firstly, here [carbon credit] they are “redeemable” securities (intended for redemption in a particular type of good or law, as explained above) and not in instruments that generate a financial income per se. In the CVM Process in RJ 2003/499, the line adopted by the Reporting Director was different, assuming the interpretation that the existence of a secondary market, in which securities may be sold with gain, would allow the recognition of the profitability of the securities instruments. I understand that this lucrative character should concern the title itself, being directly related to its nature as an investment instrument.

(our emphasis).

Similarly, in the Atlas Quantum Case Memorandum, mention is made of the Howey Test requirements, pointing out the administrative leading case:

22. In this line, it is necessary to shed light on the winning vote of the Reporting Director Marcos Barbosa Pinto in the judgment of the Administrative Proceeding (“PA”) CVM RJ 2007 / 11.593 (2), when he listed six requirements for the characterization of specific arrangements such as collective investment contracts, which have since guided the analysis of the technical area. They are: (i) the existence of an investment;

(ii) the formalization of the investment in a security or contract, however, regardless of the legal nature of the instrument or set of instruments adopted;

(iii) the collective character of the investment; (iv) the right, arising from the investment, to some form of remuneration; (v) such reward derives from the efforts of the entrepreneur or third parties other than the investor; and (vi) that the securities or contracts are subject to a public offering.

26 Available at:

Since then this methodology (PA / CVM No. RJ 2007/11593) has been used by the CVM as a criterion to configure collective investment contracts as securities, according to item IX of art. 2 of Law No. 6.385/76.

As it turns out, to be configured as a security, the income must be related to the holding of securities – in this case, tokens. However, in the case of the referral bonus, the amounts are received because of the referral itself, and not because of the number of tokens the indicator has. As a result, a user with only one MNS token and referring 50 high-volume investors will receive more bonuses than a user with a large amount of MNS tokens but has not indicted anyone. Disconnected from receipt of token holdings, it is not possible to talk about securities.

Finally, the promise of incentives and promotions presents the benefits of exclusive access, among other possibilities. This advantage, although it may be related to the number of tokens maintained by the user, does not configure remuneration. In this respect, token functionality can easily be framed as a “ticket/coupon”, once again highlighting the function of Monnos Token as a utility token.

Thus, Monnos Token does not have enough characteristics to qualify as a security, given that even its bonuses are not income from the investment. The absence of remuneration for their holders precludes any interpretation that it could be a collective investment agreement, and the other securities listed in art. 2 of Law No. 6.385/76. Accordingly, there is no regulation applicable to the Monnos Token in Brazilian jurisdiction, but the most general legal duties applicable to contracts, transactions, advertising, and other activities that Monnos may incur, even indirectly, should be observed.

The study on the legal nature of crypto-asset products in the European Union begins with the consultation of the treatment given by European capital market regulatory authorities to such crypto asset products. This is because the starting point for the discussion about the legal qualification of crypto-assets primarily involves problems between Initial Coin Offerings (ICOs) and possible violations of financial system regulatory laws.

Therefore, this opinion has as its starting point the study of the legal system of the European financial market and the performance of its regulatory bodies, the main stakeholders in the categorization of crypto-assets. It is worth noting that the European financial market is regulated at the Community level by the European Union. As a result, related EU normative acts are of fundamental importance for the legal analysis in this opinion.

First, it is indicated that, according to art. 288 of the Treaty on the Functioning of the European Union, to exercise EU competences, the Community institutions adopt the following normative acts: regulations, directives, decisions, recommendations, and opinions. These instruments represent secondary legislation, the primary one being the treaties and general principles adopted at the Community level.

EU regulations are general in nature and binding in their entirety and directly applicable in all Member States. The Directives, in turn, bind the Member States only concerning the result to be achieved, i.e., the form and means of achieving such results. However, they are freely set by the national authorities.

Since 1999, the EU has been regulating the European capital market, establishing a series of directives and regulations to control various aspects of this market, such as creating prospectus rules, transparency rules and so on. The European Commission is currently aiming to integrate all the bloc’s markets, further refining the EU’s free movement of capital system27.

Today, the European Security Market Authority (ESMA) is the EU entity responsible for supervising the capital market at the Community level. ESMA describes itself as “an independent Community authority that contributes to safeguarding the stability of the EU financial system, enhancing investor protection and promoting the stability of financial markets”28.

ESMA is part of the European Financial Supervisory System (ESFS), which is composed of three supervisory authorities: the European Securities and Markets Authority (ESMA), the European Banking Authority (EBA) and the European Insurance and Occupational Pensions Authority (EIOPA).

27Available at:

28 Available at:

The system also includes the European Systemic Risk Board (ESRB) as well as the Joint Committee of European Supervisory Authorities and national supervisory authorities.

ESMA’s missions include conducting a risk assessment for investors, the market, and overall financial stability. Based on the risk analysis function, ESMA has the power to closely monitor the benefits and risks of financial innovations in the European market.

It was based on this competence that ESMA recently undertook an in-depth study of the crypto market. The objective was to understand the types of crypto stocks, to classify them, and then to assess the degree of risk that the nearest financial sector crypto stocks offer to the European capital market. Besides, ESMA also evaluated the dangers that unregulated crypto-assets pose to investors and submitted proposals for sector regulation29.

Finally, in January 2019, ESMA publishes its opinion30 to the Institutions of the European Union (EU) – Commission, Council, and Parliament – on initial coin offerings and crypto. Among other aspects, the opinion deals ostensibly with the legal qualification of crypto-assets, from the perspective of the capital markets legal system (financial securities law).

It should be noted, however, that ESMA was not the only European financial supervisory authority interested in the study of crypto economics. The EBA also issued an opinion in the same period (January 2019), addressing the crypto market from the perspective of the Second Electronic Currency Directive (Directive 2009/110/EC) and the Second Payment Services Directive (Directive 2015/2366 / EU)31.

The positions of ESMA and EBA will be analyzed in detail and brought into line with Community legislation and specialized doctrine, with a view to better defining the dominant criteria for the legal qualification of crypto in the EU, so that a final judgment can be made about the Monnos Token.

NORMATIVE OF THE EUROPEAN UNION ON TOKENS

ESMA’S POSITION

Hundreds of crypto-assets have been issued since Bitcoin was launched in 2009. However, although they share the same technology base – the blockchain – the diversity of features and functions that these crypto-assets have occupied in the most diverse sectors of the economy is quite vast.

29 Available at:

30 ESMA. Advice – Initial Coin Offerings and Crypto-Assets, 2019. Available at: https://www.esma.europa.eu/file/49978/download?token=56LqdNMN. Accessed Aug 12 of 2019.

31 EBA. Report with advice for the European Commission on crypto-assets, 2019. Available at:

Because of their diversity, while some crypto companies may fall within the scope of the EU Financial Regulation, others may be outside that scope. For this reason, the need arises for the distinction and organization of crypto-assets classes, whose system must be based on legal parameters. This was ESMA’s position in its report32.

Despite the need for the legal qualification of crypto for the correct legal-regulatory treatment of the various market segments that have been developed through blockchain technology, there is currently no legal concept of crypto for community-level financial markets legislation33.

Notwithstanding the lack of a specific concept, ESMA understands that the best way to pursue the legal qualification of cryptographic assets is by analyzing these digital assets considering the legal concept of financial instruments provided in Markets in Financial Instruments Directive (MiFID) II.

According to art. 4 (1) (15) of MiFiD II, “Financial Instrument” is “any of the instruments specified in Annex I, Section C”. Accordingly, that regulation recognizes as financial instruments, in short, transferable securities, money market instruments, units in collective investment agreements, and derivatives34.

In turn, securities, according to art. 4 (1) (44) of MiFiD II, are:

The categories of securities that are negotiable on the capital market, except for means of payment, such as:

a) Shares of companies and other securities equivalent to shares of companies, partnerships or other entities, as well as certificates of deposit of dividends;

(b) bonds or other forms of securitized debt, including certificates of deposit of such securities;

(c) any other securities were giving entitlement to the purchase or sale of such securities or giving rise to a cash settlement determined by reference to securities, currencies, interest or yield, commodities or other indices or indicators. 35

32 ESMA. Advice – Initial Coin Offerings and Crypto-Assets, 2019, p. 18. Available at:

33 On this issue, it is essential to note that Directive 2018/843 of the European Parliament and the Council of 30 May 2018 amending Directive AML (EU) 2015/849 included the concept of “virtual currencies” in the anti-trust legislation money laundry. According to the Directive, virtual currencies are “a digital representation of value that is not issued or guaranteed by a central bank or a public authority, is not necessarily attached to a legally established currency and does not have a legal status of currency or money. , but is accepted by natural or legal persons as a means of exchange and which can be transferred, stored and traded electronically “.

34 Available in:

35 Available in:

Therefore, if the crypto meets the concept of “security” or any other concept of a financial asset, it must conform to the European financial market regulatory system.

Nevertheless, ESMA has made it clear that the useful classification of crypto as a financial instrument is the responsibility of each of the National Authorities and will depend on the specific state application of EU law.

As a result, ESMA sought to consult the Member States, presenting them with a series of real crypto-assets with varying characteristics (utility, investment and utility-investment, and payment-investment hybrids) to ascertain the behavior of national legislation vis-à-vis legal framing challenge of these digital assets.

The result of the consultation made it clear that the competent national authorities of the Member States, in the course of transposing MiFID into their federal legislation, defined the legal term ‘financial instrument’ differently. While some employ a restrictive list of examples to describe securities, others use broader interpretations. This kind of attitude opens the door to legal uncertainty at the European level, as there is a lack of uniformity in the regulatory treatment of crypto-assets offered in Europe.

However, what draws the most attention in ESMA’s research is the fact that the only uniformly treated crypto-asset was the one pre-qualified as a pure utility. On this point, ESMA added as follows:

The fact that no NCA labeled case 5 as transferable security and/or financial instrument suggests that pure utility-type crypto-assets may fall outside of the existing financial regulation across the Member States. The rights that they convey seem to be too far away from the financial and monetary structure of transferable security and/or a financial instrument36.

Thus, despite a lack of European consensus on the legal definition of tokens bearing investment aspects, those purely utility-type cryptos are unanimously viewed as beyond the reach of financial sector legislation.

It remains to be identified, which is the pre-classification of the crypto-asset adopted by ESMA and what is the specific concept given to the utility crypto-asset. The answer is as follows:

Crypto-assets may have different features and/or serve different functions. Some crypto-assets, sometimes referred to as ‘investment-type’ crypto-assets may have some profit rights attached, like equities, equity-

36 ESMA. Advice – Initial Coin Offerings and Crypto-Assets, 2019, p. 20. Available at:

like instruments or non-equity instruments. Others, so-called ‘utility-type’ crypto-assets, provide some ‘utility’ or consumption rights, e.g., the ability to use them to access or buy some of the services/products that the ecosystem in which they are built aims to offer. Others, so-called ‘payment-type’ crypto-assets, have no tangible value, except for the expectation they may serve as a means of exchange or payment to pay for goods or services that are external to the ecosystem in which they are built. Also, many have hybrid features or may evolve.

As such, ESMA considered utility-type to be crypto that provides some “utility” or consumption rights, for example, the ability to use them to access or purchase some of the services/products that the ecosystem in which they are built has objective to offer. On the other hand, investment-type crypto will be those associated with profit-sharing rights, or rights related to return on value or participation in a venture. Finally, payment-type is the type of crypto that has no tangible value, like Bitcoin, serving only as a means of payment.

These ideal types of crypto-asset agents can be merged into mixed character crypto-asset agents as defined by ESMA37. Mixed crypto-assets tend to be classified as securities or other financial assets whenever they have an investment character, even if combined with another utility or payment feature.

Thus, despite the gray regulatory zone that reaches the crypto-asset ones offered in Europe, it can be considered that there is a well-drawn line concerning utility tokens and payment tokens. Primarily, no EU Member State has been able to frame the utility token as a security or financial asset, thus recognizing its non-regulation. On the other hand, payment-type crypto-assets were not even considered in the research, given their apparent incompatibility with the concepts worked out by the financial market regulatory system.

It is understood that the report submitted by ESMA, although inconclusive on several points, offers enough tools for the legal qualification of Monnos token considering European legislation, given that Monnos Token has token utility functionality.

Therefore, in appreciating the functions of Monnos Token will be scored primarily if the token has unique features of “utility”. This is because ESMA’s Opinion, as well as much of the specialized doctrine 38-39, recognizes that the applicability of EU securities regulation should focus on crypto securities that are characterized as an investment, such as a promise to participate in the cash flow generated by the project. The mere possibility of appreciation of the value should not be enough to equalize tokens with securities40, nor is the slight possibility of trading in a secondary market sufficient41.

37 ESMA. Annex 1 – Legal qualification of crypto-assets – survey to NCAs, 2019. Available at:

38 HACKER, Philipp; THOMALE, Chris. Crypto-Securities Regulation: ICOs, Token Sales, and Cryptocurrencies under EU Financial Law. European Company and Financial Law Review Forthcoming, 22 November 2017. Available at:

39 In the same sense: MAUME, Philipp and FROMBERFER, Mathias. Regulation of Initial Coin Offerings: Reconciling U.S. and U.S. Securities Laws, Chicago Journal of International Law: vol. 19: No. 2, Article 5, 2019. Available at:

EBA’S POSITION

The EBA observations outlined in the January 2019 report are related to the applicability and suitability of AMLD42, CRD43 / CRR44, EMD245, and PSD246 to crypto-asset and activities involving crypto-assets47.

However, for this analysis, the EBA report will be explored only concerning the application of legislation that may determine the legal nature of any crypto. For this reason, attention will be paid to EMD2 and PSD2, Directives that give crypto legal qualifications under the traditional European Community payment system.

According to the EBA Report, crypto securities are neither banknotes nor scriptural money. Therefore, they do not fit the definition of “funds” set out in Article 4 (25) of the PSD2 unless they qualify as “electronic money” for EMD248.

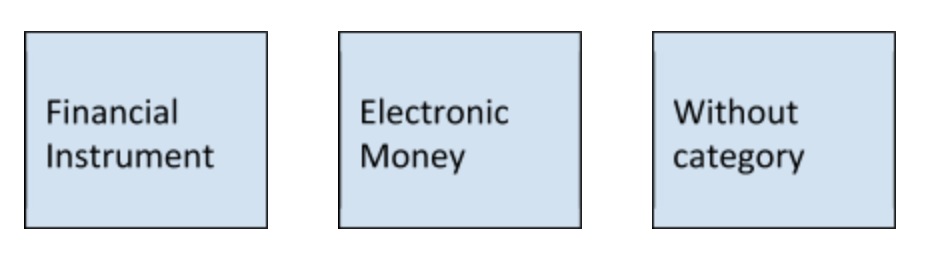

Thus, according to the EBA, the legal qualification of crypto-assets under the European Union regulatory system can now be represented by the following diagram:

40 HACKER, Philipp; THOMALE, Chris. Crypto-Securities Regulation: ICOs, Token Sales, and Cryptocurrencies under EU Financial Law. European Company and Financial Law Review Forthcoming, 22 November 2017. Available at:

41 MAUME, Philipp, and FROMBERFER, Mathias. Regulation of Initial Coin Offerings: Reconciling the U.S. and U.S. Securities Laws. Chicago Journal of International Law: Vol. 19: No. 2, Article 5, 2019.

42 Directive 2015/849 / EU: Anti-Money Laundering Directive.

43 Directive 2013/36 / EU: Capital Requirements Directive.

44 Regulation (EU) No 575/2013: Capital Requirements Regulation

45 Directive 2009/110 / EC: Second Electronic Money Directive.

46 Directive 2015/2366 / EU: Second Payment Services Directive or Second Payment Services Directive.

47 EBA. Report with advice for the European Commission on crypto-assets, 2019. Available at:

48 Ibid., P. 14

This qualification diagram can be applied to all currently recognized crypto classes, i.e., payment/exchange/currency tokens49, investment tokens50, and utility tokens51, as the EBA itself has well defined.

Once the discussion on crypto as a financial instrument is over, the criteria for framing these assets need to be assessed against the legal concept of “electronic money” provided for in EU law.

Crypto is classified as electronic money as defined in Article 2 (2) EMD2 if and only if it satisfies each of the elements of the definition of the concept. Let’s see:

‘Electronic money’ means ‘electronically, including magnetically, stored monetary value as represented by a claim on the issuer which is issued on receipt of funds for the purpose of making payment transactions as defined in point 5 of Article 4 of [PSD2], and which is accepted by a natural or legal person other than the electronic money issuer’52.

Based on this definition, the EBA came to understand that crypto will be considered electronic money for art. 2 (1) of EMD2 if the following characteristics are found:

(a) have monetary value;

(b) be stored electronically;

c) Represent a claim about the issuer;

d) Be issued upon receipt of funds;

e) Be issued to make payment transactions;

f) Be accepted by persons other than the issuer.

EBA’s position is that even payment-type crypto will be considered electronic money for EMD2 purposes only if all criteria are cumulatively met.

49 The report points out that the term is used to refer to “virtual currencies” (virtual currencies or cryptocurrencies). Conceptual EBA payments tokens are as follows: tokens that “usually do not provide rights but are used as a means of exchange (for example, to allow the purchase or sale of a good supplied by someone other than the token issuer), to investment purposes or for the storage of value. Examples include Bitcoin and Litecoin”.

According to the Report, they are tokens that typically provide rights (for example, some form of property rights and/or dividend-like rights). It has full application in the context of capital raising via the ICO’s (Initial Coin Offering).

51 According to the EBA, utility tokens generally allow access to specific products or services, usually provided from a DLT platform, but are not accepted as a payment method for other products or services. For example, in the context of cloud services, a token may be issued for easy access.

52 EBA. Same, p. 12

3.2 SUBSUMPTION

Having presented the normative parameters used by the EU for the legal qualification of the crypto-asset ones, it is possible to make the Monnos Token subsumption judgment based on these parameters.

Considering the data provided by the Consultant, it is noted that Monnos Token is not a simple payment token, as it incorporates certain rights/functionality for exclusive use on the platform. According to what has been found, Monnos Token will function as an access token to unique services and products within the platform and as a payment token within the platform.

Considering these rights and features of Monnos Token, it is noted that this is presented as a platform marketing vehicle since it is created as a tool to encourage the use of the platform and customer loyalty. At the same time, the token may also circulate through other exchanges.

Therefore, Monnos Token do not qualify as a ‘security’ and cannot be compared to any other type of financial instrument listed in art. 4 (1) (15) of MiFiD II.

Although these tokens are presented as a standardized class of digital assets that meets the standardization and transferability criteria required by MiFiD II (art. 4 (1) (44)) 53-54, Monnos Tokens cannot be traded in the capital market55, as it does not have investment characteristics. Also, the asset under examination does not have features comparable to the list of examples presented in art. 4 (1) (44) of MiFiD II, such as shares or debt securities.

The concept of ‘capital market’ is not defined by MiFiD II, but is understood by the Financial Authorities as broadly as possible, i.e., as any organized space to facilitate the transfer of resources from surplus economic agents to deficit economic agents.

This broad definition of the capital market is associated with the role that this sector of the market plays in the economy. The International Organization of Securities Commissions

53 On the question: HACKER, Philipp; THOMALE, Chris. Crypto-Securities Regulation: ICOs, Token Sales, and Cryptocurrencies under EU Financial Law. European Company and Financial Law Review Forthcoming, 22 November 2017. Available at:

54 See also: MAUME, Philipp and FROMBERFER, Mathias. Regulation of Initial Coin Offerings: Reconciling the U.S. and U.S. Securities Laws. Chicago Journal of International Law: Vol. 19: No. 2, Article 5, 2019. Available at:

55 EOS, Frequently Asked Questions (“Frequently Asked Questions on MiFID Markets in Financial Instruments Directive 2004/39 / EC and implementing measure”). Answer to question number 60: “To be financial instruments. Those shares must be transferable securities within the meaning of Article 4 (1) (18) of MiFID and, be ‘negotiable on the capital market’. Those terms have to be understood broadly in the sense that only under limited circumstances will share that is negotiated not to fall under the definition of financial instrument”.

(IOSCO), the international technical authority on the subject, understands that the securities market plays a fundamental role in raising funds, allocating resources, and financing public and private ventures56.

It is only by understanding the role of the capital market in the economy that it will be possible to effectively and rationally delimit the scope of legislation that regulates the sector. Any legal interpretation that serves the purpose of expanding the state’s regulatory power beyond the protective objectives of the law itself violates the fundamental rights and freedoms of citizens.

Understanding this point, it is noted that EU capital market legislation does not lend itself to regulating the market, but only a small portion of the financial market, and therefore does not lend itself to protecting the general consumer, but only investors.

For these reasons, Monnos Token is not characterized as a “security” or “financial instrument” as defined by Community law. According to the information found, the token does not represent any form of investment, debt securities, promises any profitability, nor gives its holder any right to participate in companies. Monnos Token can be qualified as a simple token utility and is therefore outside the regulatory scope of EU financial market legislation.

Monnos Token is not configured as “e-money” for EMD2 purposes either. This is because it is not issued upon receipt of funds, nor is it considered a tool for electronic storage of monetary value. It is emphasized that electronic storage of monetary value does not mean a simple economic appreciation of the token. To think otherwise would be to attribute to every digital good that has economic value the character of electronic money. The term “electronically stored monetary value” means that digital data represents a monetary unit of value as if it were a fiduciary currency.

As a result, the fact that Monnos Token has economic value is not enough to qualify it as an ‘electronic currency’ for EU Community law.

Indeed, and based on the analysis of the Community legislative landscape to date, it appears that the Monnos Token does not fall within the scope of the current EU financial services legislation. Consequently, activities involving these crypto-assets are not subject to a standard regulatory scheme in the EU.

56 That statement is referred to in the recitals in the IOSCO By-Laws. In the original: “CONSIDERING that the securities markets play the fundamental role in raising funds, the allocation of resources and the financing of enterprises and public entities; WHEREAS the securities markets allow the offer of a wide selection of financing instruments to enterprises and public entities, and a wide choice of investment instruments to investors (…) ”. Available in:

This opinion has dealt with the regulatory issue of cryptocurrencies in three different jurisdictions: Switzerland, Brazil, and the European Union. As shown, Monnos Token does not feature as an investment, which is why it cannot be classified as a security.

For the Swiss securities regulator, only security/asset tokens are under its jurisdiction. The absence of investment purpose precludes such classification, being Monnos Token understood as a hybrid token, partly utility, partly payment.

In Brazil, although by different methods, the same conclusion is reached: for the Securities Commission to exercise its regulatory role over the cryptocurrencies, it should reward its holders – which, in the case of Monnos Token, does not occur. Thus, there is no specific regulation to be followed.

Finally, the positions of the European Union regarding crypto-assets were analyzed. Bypassing concepts such as “security” or “financial instrument”, there is no community-wide regulation to prevent their free distribution. However, it is noteworthy that the member countries of the European Union, by contrast, may have more advanced regulation. Since this opinion was not intended to qualify Monnos Token in the light of the national laws of all EU Member States, this conclusion is not a definitive judgment for all the Sovereignties of the European Community, which may create specific criteria and regulations for the treatment of crypto-assets.

This way, it is oppressed by the inexistence of norm that conditions the offer of Monnos Token by its condition of cryptocurrency within the analyzed legal universe.

That is the opinion, in 31 pages, barring better judgement

São Paulo, 12th September 2019.

Yure Lira

Lawyer, OAB/PB nº 19.285

Ylana Lira

Lawyer, OAB/SP nº 428.848

Caio Oliveira

Lawyer, OAB/PB nº 19.742

Last updated: September 11, 2019

The careful reading of this document in its entirety is essential to understanding the extent of the Monnos token purchaser’s (“MNS token”) rights, obligations and related responsibilities, as this Agreement constitutes the Monnos Tokens Purchase Agreement (“Agreement”) and is the legal basis, in conjunction with the Monnos Platform Terms of Service and Privacy Policy, governing the relationship between the buyer of Monnos tokens (“Buyer”) and Monnos.

If you have any questions, you are advised to consult a professional – financial, legal or any other specialist – for clarification on the token market. If the entire content of this or any other document governing the MNS token or use of the Monnos platform is not in agreement, the Buyer shall refrain from any kind of operation.

The Token Market has specific risks such as market risks, hacking, vulnerability, volatility, loss of private-key, regulatory risks, bankruptcy or dissolution, among others, provided for herein, but not limited to the list presented here. Carefully read this document and all other documents governing your relationship with Monnos, as well as seek information, with the help of professionals in the field, about all risks involved in any decision in this market.

Therefore, before engaging in any purchase or sale of crypto-assets, make sure that you understand and have experience with cryptocurrencies, blockchain systems and services, and understand the risks associated with digital token trading, as well as the mechanism related to the use of cryptocurrencies