Scan with

your phone

We have a big crypto portfolio and we add one new crypto every 15 days, this way you will never miss the opportunity to invest in the best project in the market

Start to use your crypto in your daily basis. Buy all the products and services you love and get up to 8% cashback.

Our marketplace is made up of arts made in conjunction with our commercial partners and all NFTs have embedded benefits, such as awards, philanthropy and others. We are the world's first Utility NFTs platform.

With Monnos you can synchronize your wallet with other users strategies and copy automatically everything they do. Trade like a pro without the need of becoming one.

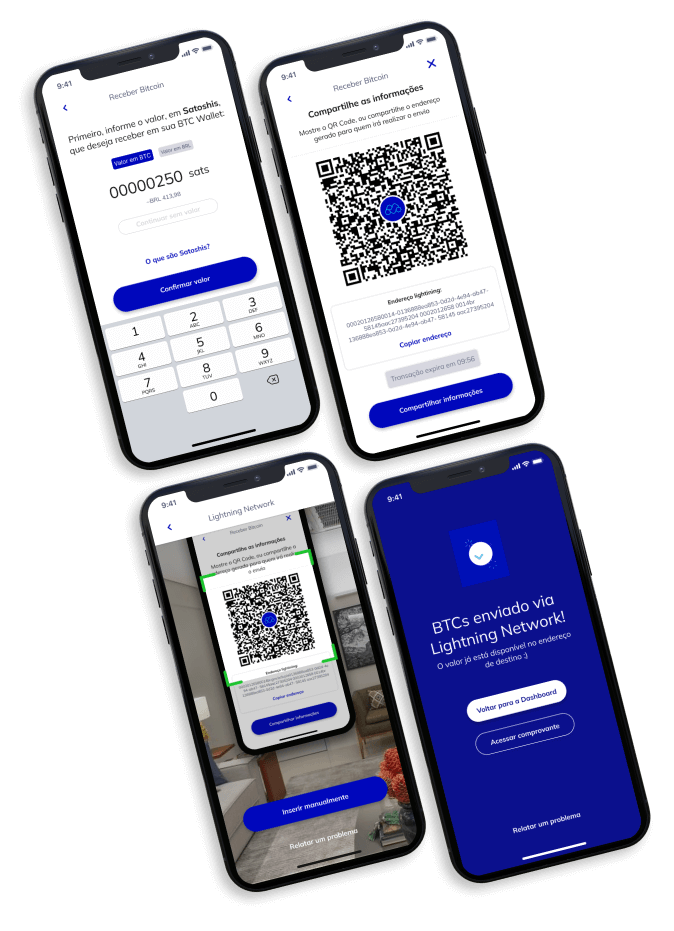

Save time and money when using your BTC as payment. With Lightning Network, Bitcoin transactions are very fast and cheap.

MNS is a digital asset, just like Bitcoin, however, it is the currency of Monnos. The more MNS you have in your custody, the more benefits you get. In addition, you will also be able to grow with Monnos as the asset is valued, as a result of the development and recognition of our product.

Your assets will be protected by the highest security standard provided by our partner BitGo, the world leader in asset custody, processing more than $10 billion in transactions monthly. Market leading companies like Kraken, Nexo, CME Group, Pantera Capital and Upbit also trust BitGO.